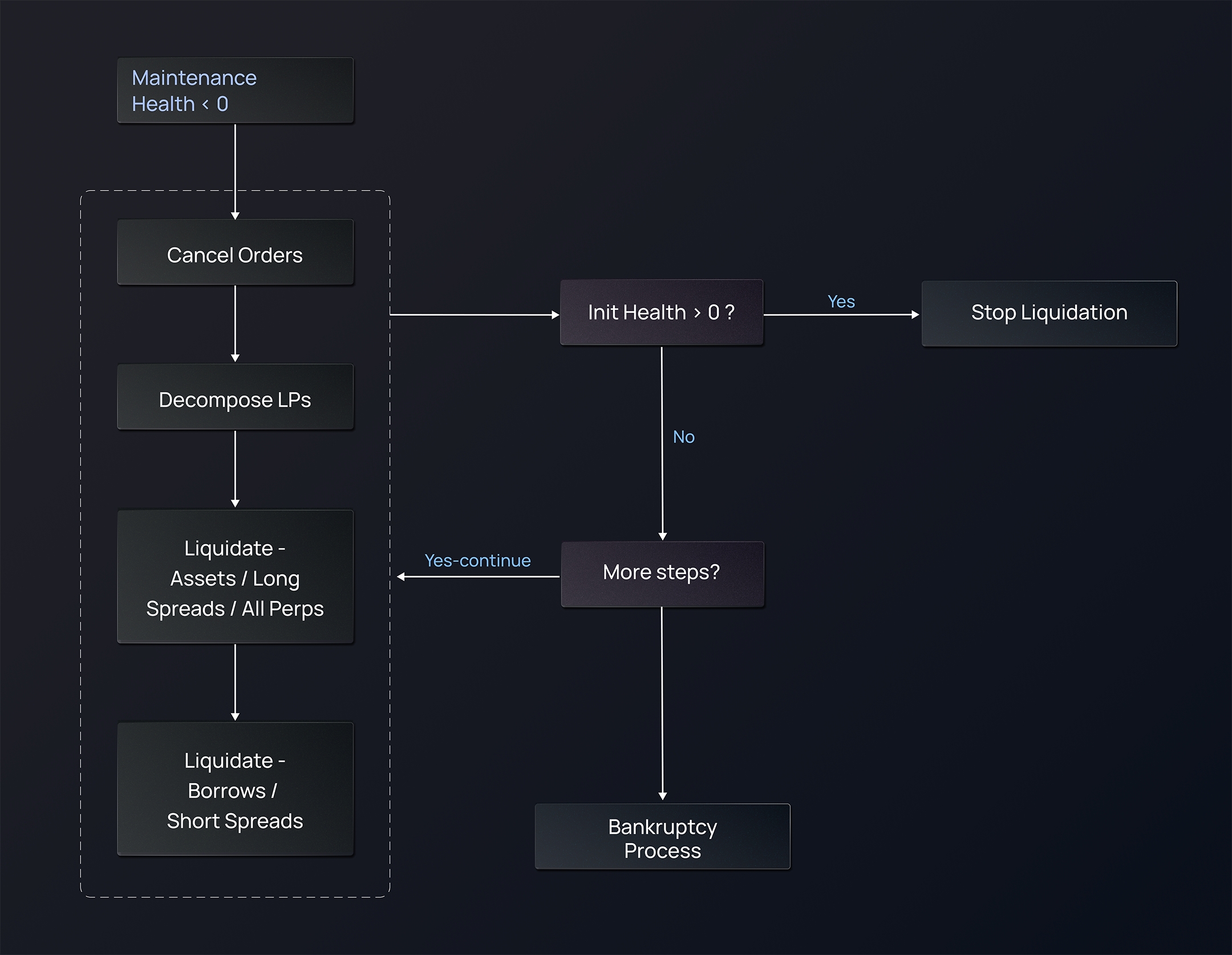

Liquidations on DOPP happen at the mark oracle price, derived from a third-party oracle (Pragma - see Oracles section to learn more). Liquidations protect the protocol and users from the risk of systemic bankruptcy. When an accounts maintenance health falls below 0, it enters liquidation. The assets and perpetual positions of the subaccount will be closed in the following order:

- Orders are canceled.

- LPs are decomposed.

- Assets are liquidated (USDC Balances/Options Positions/Perps).

- Liabilities are liquidated (Borrows/Short Spreads).